Helping Businesses in

Making Tax Digital

Care Accountancy works with businesses in assisting them in Making Tax Digital (MTD) and meeting the regulatory rules, regulations, and deadlines. We ensure VAT registered businesses above the VAT threshold comply with the regulations of Making Tax Digital. By providing MTD regulations, companies can improve their efficiency and effectiveness in getting their taxes right and keeping and maintaining digital VAT records.

We help businesses use the right software to submit their VAT returns, MTD, MTD compatible software and meet make-tax-digital deadlines.

Tech keeps going,

And going, And going!

MTD is the new digital tax system introduced by the HMRC and key part of the government’s plan for comparatively accurate and easier tax computations for most businesses and individuals.

This new system will accelerate the time it takes to file the tax returns for individuals and companies. MTD is making considerable changes to the conventional taxation system so that it is more productive, efficient and simple. Making Tax Digital is a step by the HMRC towards becoming one of the most up-to-date tax administrations in the world.

HMRC is encouraging businesses with a taxable turnover below the VAT threshold to sign up so they can also benefit from MTD. Businesses can also sign up for MTD for Income Tax. This means, subject to the business type, businesses can further streamline their business processes. The software can help businesses to stay on top of business record keeping, allowing them to better understand how their business is performing.

What Is MTD For Income Tax Self-Assessment (ITSA)?

Under the requirements of MTD for ITSA, individuals who are subject to income tax on the profits of their trade, profession, vocation, or property business will be required to keep their accounting records electronically (either using suitable software or on a spreadsheet) and file quarterly returns to HMRC with details of their income and expenditure together with any other information that HMRC specifies. A final end-of-period statement will then be submitted after the tax year to complete the individual’s tax affairs.

Very large companies with annual profits of over £20 million are currently required to pay their Corporate Tax in quarterly installments throughout their accounting period. HMRC has not proposed that these entities make quarterly reports under MTD although they will still need to keep appropriate digital records. However, consultations are still underway on the proposed scope and operations of MTD for Corporations.

Effective April 2021 if businesses have not signed up to MTD for VAT they will no longer be able to submit VAT Returns under the old XML-based system. This means that businesses will no longer be able to use third-party software. However, HMRC will be adding functionality to the Business Tax Account to submit returns until April 2022 or businesses can continue to use third-party software by signing up for MTD for VAT early.

To be within scope, the individual must have an entire business or property income above £10K per year, which applies to gross income or turnover, not profit.

Disclaimer

We understand that it applies to the total gross income where the individual or entity has more than one trade or property business. For example, suppose the individual has £6K of rental income and £7K of sales from a sole trader business. In that case, they will exceed the limit and be in scope.

In line with the exemptions for MTD for VAT, individuals should not have to follow the MTD for Income tax rules if any of the following apply:

- It’s not reasonably practicable for them to use digital tools to keep their business records or submit quarterly returns due to age, disability, remoteness of location or any other reason.

- They are subject to an insolvency procedure.

- The business is run entirely by practising members of a religious society or order whose beliefs are incompatible with using electronic communications or electronic records.

- Non-resident companies

- Trustees, executors, and administrators

- Foreign businesses of non-UK domiciled individuals.

Where any of the above apply, the individual has to apply to HMRC to claim an exemption, with HMRC having 28 days to either grant or deny the application. Where a business has already qualified for an exemption from MTD for VAT, they will also be exempt from MTD for Income tax.

What Is MTD For Value Added Tax (Vat)?

As a VAT registered business, there is increased management of cash flows. A separate VAT account is needed in which VAT on sales is credited, and VAT on purchases is debited. VAT registered businesses collect VAT from their customers on behalf of HMRC, report it correctly using recommended software by the HMRC, and ultimately pay the correct VAT on time. Any excess VAT collected is paid to the HMRC, and the amount which is overpaid as VAT can be reclaimed from the HMRC.

Making Tax Digital (MTD) for VAT requires VAT-registered businesses with taxable turnover above the VAT registration threshold (currently £85K) to keep records digitally and submit their VAT returns using MTD software. Most businesses have had to submit MTD VAT Returns for periods starting on or after 1 April 2019. This will however be mandatory for the remaining VAT registered businesses by 1 April 2022.

All the VAT registered businesses who reach their annual taxable income above the VAT threshold, currently at 85k, are required to keep track of Making Tax Digital rules and regulations, keep their VAT records digitally and submit their VAT Returns using MTD software.

The recordkeeping for the transactions is almost the same as before such as keeping the VAT record for all sales and purchases, keeping a separate VAT account, issuing correct VAT invoices, but these must be recorded digitally by using HMRC approved software. The VAT registered businesses will have to submit their VAT returns to HMRC in quarterly sessions by using approved software.

All the eligible businesses will need to use “Compatible Software” to keep the track of their financial information digitally. Businesses are required to use that Software that has been pre-approved by HMRC which can connect to the tax authority’s systems. A single application can be used however if multiple programs are in use these should be digitally linked together however, they must be proficient enough to:

- Keep the records digitally

- Automatically provide HMRC with necessary VAT information

- The user should be able to generate and file VAT returns

- Automatically update the information about the business, held by the HMRC

Effective April 2022, if the taxable turnover of your business drops below the VAT registration threshold, you’re still required to continue to keep digital records and send HMRC your VAT returns using MTD-compatible software but not if your business de-registers from VAT or is exempt from MTD for VAT.

MTD does not require any additional records for VAT, but to record them digitally including your business name, principal business address, VAT registration number and details of any VAT accounting schemes you use. For each supply, the time of supply (tax point), the value of the supply (net excluding VAT) and the rate of VAT charged. There has been no change in the following:

- Monthly, quarterly, or annually completion of VAT returns

- Making VAT payments on the current payment due dates

- No additional records required for VAT purposes

- Use of Spreadsheets permitted to record business transactions

- Current exemptions from online filing will continue

The digital records need to be retained and the way in which VAT returns are filed with HMRC.

Determining when to sign up for MTD can have a notable impact on your forthcoming reporting and recordkeeping requirements and may lead to some financial penalties. It is recommended that you should sign up for MTD after you have submitted your old (non-MTD) tax return.

Care Accountancy can help you understand the extremes of Making Tax Digital and to incorporate it into your business.

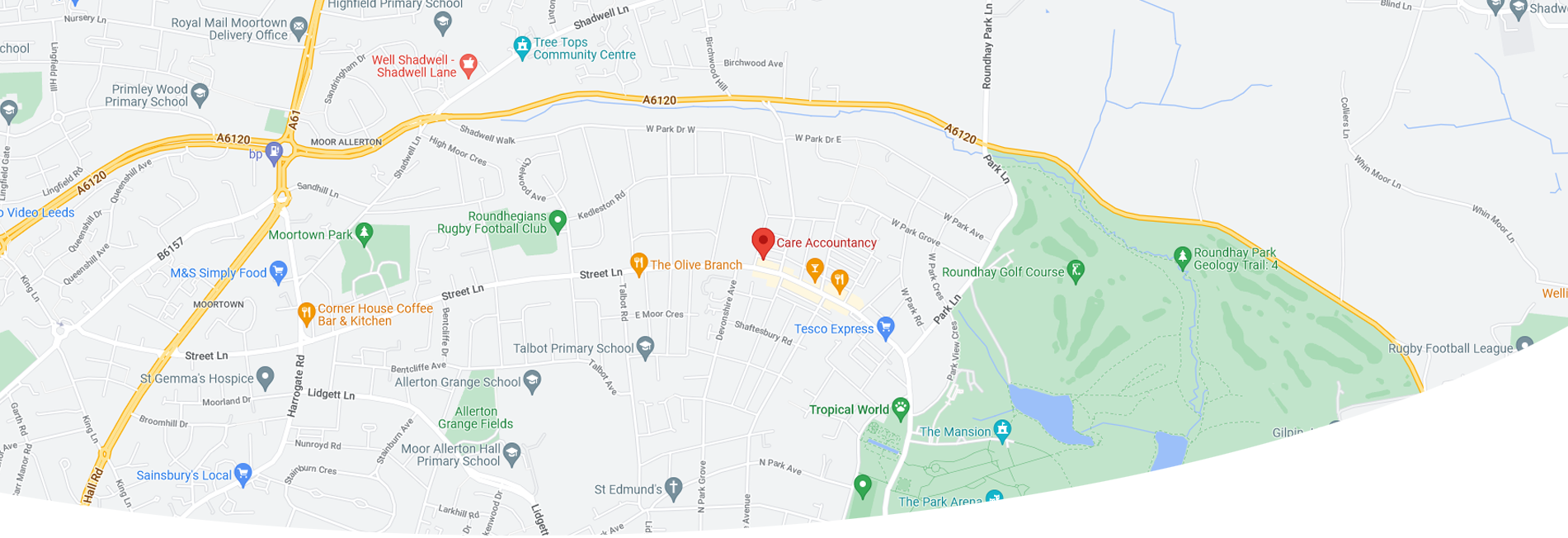

Get in Touch

Rhoundhay

Leeds

LS8 2AL, UK

Coventry Road

Birmingham

B26 3EJ, UK

0121 7268 542

info@careaccountancy.co.uk