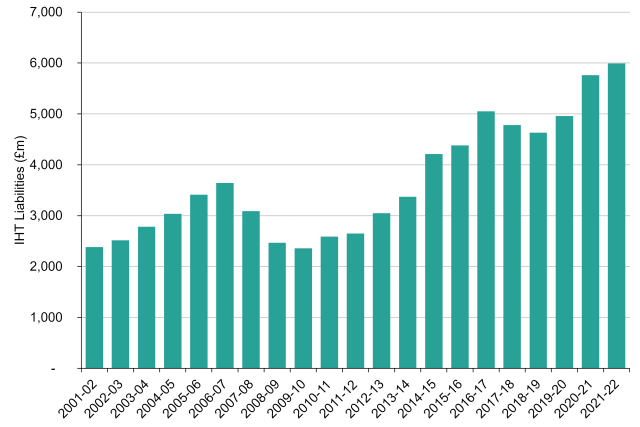

The landscape of inheritance tax (IHT) in the UK is evolving, with an increasing number of estates being drawn into the IHT net. The number of deaths resulting in an inheritance tax (IHT) charge in the 2021/22 tax year rose by 3 per cent to 27,800, according to HMRC figures. This is about 4.4 per cent of total UK deaths. IHT liabilities for the year increased by 4 per cent to almost GBP6 billion. The most important IHT relief was again the spousal exemption, saving GBP15.5 billion, followed by agricultural and business property relief of GBP4.4 billion and charitable relief of GBP2.1 billion.

IHT liabilities and taxpaying estates

A chart showing IHT liabilities created by taxpaying estates in the stated tax year.

This growth is largely attributed to the rising property prices and the unchanged IHT threshold, which has remained at £325,000 since 2009. As property values soar, especially in regions like London and the Southeast, more families find their estates exceeding the IHT threshold, resulting in a 40% tax on the value above this limit. This situation poses significant financial challenges for beneficiaries, who may need to sell inherited assets to meet the tax obligations.

However, there are strategies to mitigate IHT liabilities. One effective approach is the use of lifetime gifts, which can reduce the value of the estate subject to IHT if the donor survives for seven years after making the gift. Additionally, setting up a family investment company can be a tax-efficient way to manage and pass on wealth.

At Care Accountancy, we specialize in IHT planning and can help you navigate the complexities of estate management. Our team provides personalized advice to ensure your estate is structured efficiently, preserving more of your wealth for future generations. Contact us today to learn how we can assist you in safeguarding your legacy.

For more information, visit us at Care Accountancy.

Disclaimer

The information on this Blog is for general purposes only on matters of interest. The Company assumes no responsibility for errors or omissions in the Blog’s contents. Even if the Company takes every precaution to ensure the Blog’s content is current and accurate, errors can occur. Given the changing nature of laws, rules, and regulations, there may be delays, omissions or inaccuracies in the information on the Blog. The Company is not responsible for any errors or omissions or the results obtained from this information. The Company reserves the right to make additions, deletions, or modifications to the Blog’s contents without prior notice.

In no event shall the Company be liable for any special, direct, indirect, consequential, or incidental damages or any damages whatsoever, whether in an action of contract, negligence, or another tort, arising out of or in connection with the use of the Blog or the contents of the Blog. The Company does not warrant that the Blog is free of viruses or other harmful components.

Please read our disclaimer policy.